Looking for 'solutions', NBC adjusts US Open commercial format again

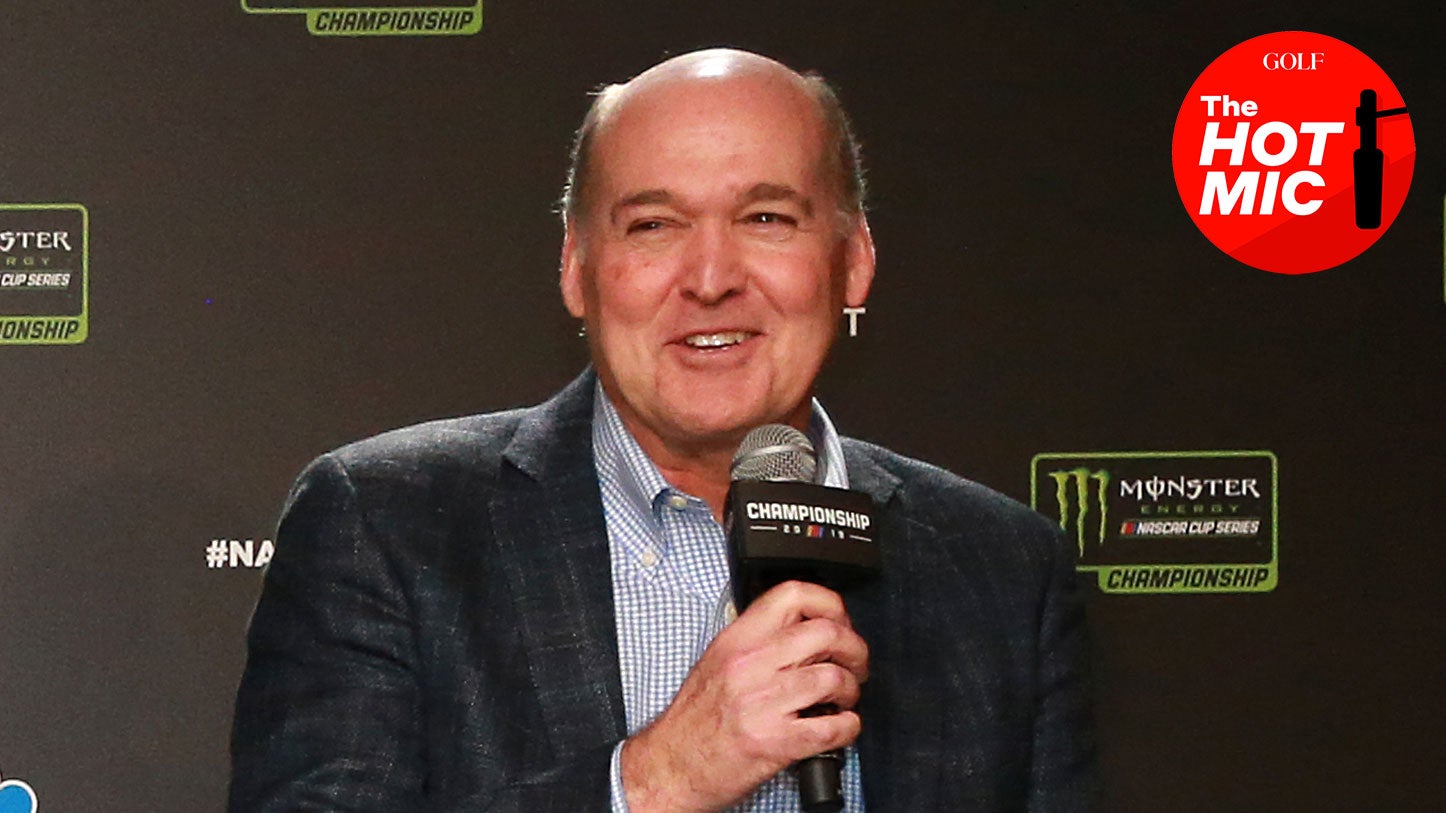

NBC Sports EP Sam Flood said the network will continue to look for ways to reduce interruptions in golf TV broadcasts.

Getty Images

NBC Sports executive producer Sam Flood knew the questions were coming.

“One topic that always comes up at major events is the pace of our matches,” Flood said quietly as he opened his statement on Thursday's US Open press conference. “And obviously, unlike the NFL, NBA, Major League Baseball, there are no natural breaks in a game or golf tournament…”

He didn't say the words right, but everyone on the phone knew exactly where he was going. The flood was about to address the elephant in the room: Golf's TV commercial overload.

“We hear the comments and we know we have to look for solutions,” he said. “We are working with our partners and finding ways to make sure that as much golf as possible is shown.”

Zamcolo's words didn't come as a surprise to anyone on the phone, but his decision to say them surprised him. For the first time in his tenure as head of NBC's golf product, Flood acknowledged the growing sentiment among golf fans that NBC's TV product has become riddled with distractions. And for the first time, he admitted that he would like to solve the problem.

Now came the hard part: The plan.

***

Until LIV Golf came along, TV commercials – mostly when again how much were employed – it was one of the biggest problems in men's golf.

The explosion of the TV rights market has turned golf into a multibillion-dollar business over the past two decades, but that growth has come with a hidden price: A constant stream of ads has plagued the golf TV product, and the only distraction is growing harder over time.

To understand the problem facing golf, you only need to understand unconventional economics. The value of a television contract is directly proportional to the advertising revenue. (If advertisers are willing to spend $1 million to get their ads on television for a golf tournament, NBC will want to spend Underneath more than $1 million in broadcast rights to justify putting it on the air.) Advertising revenue is directly tied to the size and perceived value of the audience. (Golf skews toward the old and wealthy — in theory, people who can eat and advertise and play in some way — which is good news for networks.) In a healthy business environment, the supply and demand curves find equilibrium easily, allowing everyone to get a fair profit. But always – like, when a new TV deal is signed it's important way more than before – the market starts again. Suddenly the losses can exceed the profits, and the network has several options for making money: first, to increase the cost of each ad, and second, to sell more ads.

Now it should be noted that the networks do not exist what is needed signing contracts for the rights to TV shows costing a standard deviation than before, and you don't have to sign a contract that requires commercial promotion to make a profit. But if the deals are getting bigger over time, why can't the networks stop them? Well, because the networks are already connected.

You see, it's the key to the entire sports TV business shortage. Sports TV rights today are more expensive because live games generate larger, more singular audiences and stronger advertising revenue than anything else on television. As the entertainment landscape grows and breaks into the broadcast age, much has been made of the “flood” of viewers leaving traditional cable. While many thought those developments would spell the death of televised sports, the opposite has happened. Without the traditional audience for linear TV, it has become almost impossible to find the same audience and ad revenue for other types of content, which means that even though ratings for sports broadcasts are low, the lack of audience for sports TV has increased. And as scarcity increases, costs increase, even if those costs mean stretching the limits of marketers' demand.

In simple terms, here's how professional golf got into today's predicament: The money in the sports TV business is too good for anyone on either side of the ledger to pass up, but it's getting harder to generate the advertising dollars needed to keep everything moving.

The USGA's involvement in the issue began in 2020, when the governing body sold its rights to NBC (after FOX pulled out of golf coverage) for a reported $38 million a year. In a world where the rights to a single NFL playoff game go for more than $100 million, $40 million for golf's second-largest event seems like a pittance, and in some ways it is. But for NBC, there is advertising pressure – the need to sell enough spots in one weekend to cover the cost of the rest of the USGA portfolio. Pressed between the rock (risking relationships with partners by increasing the cost of each ad) and the hard place (selling more ads), NBC chose a difficult place. (A third option — generating a small profit from the USGA deal — apparently hasn't been explored.) Add in that the USGA's TV contracts provide a certain amount of television promotion alongside NBC's in-house ads, and suddenly NBC's US Open product. it feels cluttered with even the most hectic of PGA Tour televsions.

It does not mean that this situation cannot happen in the future, but as the USGA and NBC enter the negotiation window for the next round of US Open TV rights, it is difficult to find a solution that can see a number of TV golf commercials. distractions go down. On the other hand, it's hard for NBC to justify the small profit margin on its golf coverage, in particular big ticket to broadcast golf, at a time when Comcast chairman Brian Roberts is focused on lucrative businesses. On the other hand, it is difficult for the USGA to support a small rights fee at the expense of its flagship event, especially at a time when teams like the NBA and NFL are seeing their rights fees increase tenfold in deals. on NBC.

And what happens if, like in 2013, NBC finds itself fighting another network for USGA rights? The shortage will push the pricetag higher, perhaps increase number of ads shown during the US Open?

***

In recent years, commercial appeals have become the norm for US Open telecasts.

In 2022, the outrage at the Brookline event grew so intense that newly appointed USGA commissioner Mike Whan took to Twitter to directly address fans' concerns. And in 2023, Whan dedicated part of his annual USGA press conference to address the governing body's efforts to reduce markets at the LACC, saying the network was able to reduce weekend disruptions by more than 30 percent – or 19. fewer disruptions from last year.

“I'm proud of NBC,” Whan said. “They have greatly reduced their broadcasting programs. So we are on the same level. They have bills to pay and so do we, so I get that.”

“There will still be millions of people who don't like commercial disruption because no matter how low you get it, you will get that response,” said Whan. “But yes, we made an effort between the two of us.”

Commercial changes were felt somewhat over the weekend at the LACC last June, but many viewers are still troubled by the amount of interruptions throughout the tournament series. At a press day event at Pinehurst last month, NBC and USGA officials revealed they weren't entirely satisfied either, saying they went back to the drawing board again during golf to see how they could improve the product even more. All of that brought us to Thursday morning, when Zamcolo spoke to the media as part of NBC's first-ever US Open media call, fresh from the network announcing 300 hours of live coverage on several networks during the week at Pinehurst No. 2.

So what's the fix for the US Open telecast? For now, Zamcolo says, it's a band of music.

“We have to pay [for golf TV rights], so we have to work with this partnership to make all of this happen,” said Flood. “But we have found ways to minimize disruptions and redistribute resources to our broadcast.”

For now, Flood says the network has focused its efforts on improving the processes involved in televising golf, ensuring that transitions are clean and fluff is minimal. At the US Open, Zamcolo hopes that there will be visible results below those adjustments.

“For example, on Thursday, we will have two more minutes of golf per hour than in previous years,” said Flood. “And then add to that our new reading board system, our stats tell us it's going to get five more shots per hour. We can stay on the golf course and stay in the action.”

But larger, meaningful discussions about setting up the USGA's television structure will have to wait until another time for another rights deal.

“There are different ways we feel we can engage the audience and create content. We have reduced the amount of time for the promotion and reduced the amount of time it will be available [away from the action] by intelligently evaluating everything we do, where it hits and how it integrates with television,” said Flood. “We're very pleased with the way we've reframed the execution.”

It has been updated a name that should give golf fans some hope, especially considering NBC Sports' leading golf voice brought it up. But is the NBC brand a rebrand from delivering the kind of coverage golf fans crave, or is a major reshaping of golf on TV needed to deliver on those limits? And how can the network access some of the more expensive measures that may come with it?

These are the questions NBC is grappling with in the tumultuous year of 2024 — questions its leader, Sam Flood, surely knows is coming.

Soon, we will learn if you have any answers.

Source link